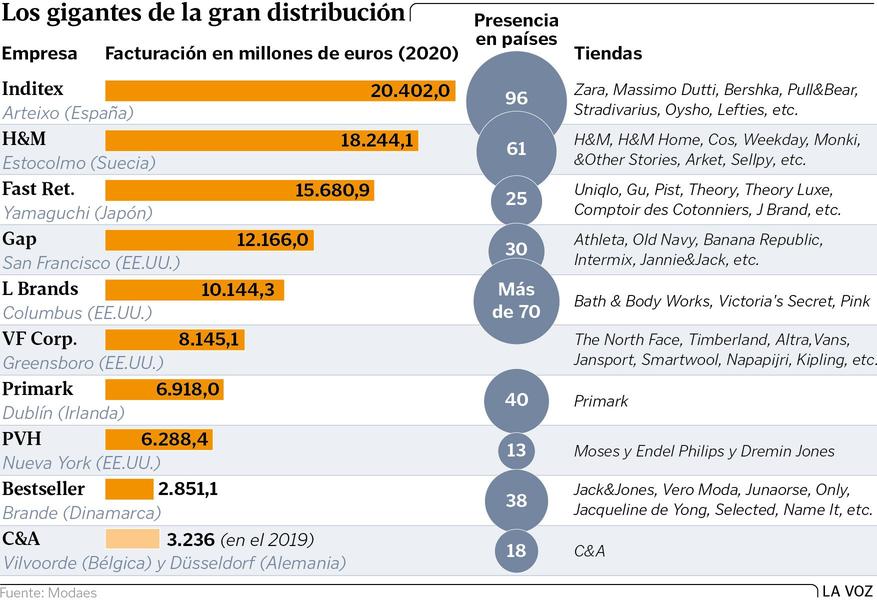

La VozThe giants of mass distribution

The battle is also waged when there is less to distribute: according to Euromonitor, the global clothing and footwear business ended 2020 with a drop of 17.3% compared to 2019, falling to 1.27 trillion euros .

This is the ranking of world fashion by turnover with data at the end of the 2020 financial year.

Inditex

20,402 million. The number one global fashion retailer reaffirms its top position after ending the year of covid 19 with a 28% drop (20,402 million euros with the year ending in January 2020), with strong growth online and a contraction in spending in line with the drop in sales thanks to its business model based on fast fashion. At the beginning of the year, before the withdrawal in China, it had 7,469 stores in 96 countries, and 85% of its sales, invoiced outside of Spain.

h&M

18.244 million. Founded in Stockholm (Sweden) in 1947, H&M has managed to capitalize in the last year on the transformation process that began in 2017 to compete in the online market, in which it had lagged behind. The company, which appointed Helena Hemersson as CEO in 2020, is exploring new formats under the Treadler and Singular Society brands. It has 518 stores in 61 countries.

fast retailing

15,680 million. It is the only Asian group (Japan 1949) in the top ten in the world of mass distribution and has managed to overcome the impact of the pandemic better than its rivals thanks to its strong presence in China, the market that recovered best. Uniqlo is the flagship of the group, which has the brands Gu, Pist, Helmut or J. Brand among its chains. It is present in 25 countries with 2,242 stores. A significant part of its sales, 51%, are outside of Japan.

gap

12.166 million. The Californian group (San Francisco, 1969) also began this year with a new CEO, Sonia Syngel, who has launched a new strategic plan until 2023 that is committed to a radical restructuring of the company, made up of brands such as Old Navy or Banana Republic. It has 3,715 stores in 30 countries. 86% of its market is American.

L brands

10.144 million. The American group was about to sell Victoria's Secret to Sycamore Partners, but after the outbreak of covid-19, the fund backed down. Last August the giant completed the segregation of that firm into an independent company, giving rise to two new companies: Bath & Body Works Inc. (the former L Brands) and Victoria's Secret & Co. The new Bath & Body Works has a network of more than 1,750 owned stores in the United States and Canada and more than 300 international franchises, as well as an online presence.

vf corporation

8.145 million. The American conglomerate has reorganized its portfolio in the last year with new purchases and divestments. At the beginning of the year, he took over Supreme, the great phenomenon of urban fashion. Founded in 1899 in Pennsylvania, the company operates with around twenty brands, including Vans, The North Face, Timberland, Kipling, Napapijri and Eastpak, with which it invoices 53% of its sales outside the US market. Now the group turns to the online channel and makes a strong commitment to Europe with a new logistics center in Leicestershire, in the center of England. The new facility will allow up to 200,000 packages to be shipped per day.

primark

6.918 million. The king of low cost has survived the confinements and the closure of stores without having online commerce. The Irish company, founded in Dublin in 1969, estimates that the impact of the closures forced by the pandemic amounted to 2,000 million pounds (2,336 million euros). It is present in 40 countries with 384 stores. 51% of its business is concentrated in the United Kingdom.

HPV

6.288 million. Under the leadership of Stefan Larsson (CEO since last October), PVH Corporation begins a new stage focused on its two main brands: Calvin Klein and Tommy Hilfiger. Last June, the company founded in 1881 in New York sold the rest of its brands (included under the Heritage Brands division) to Authentic Brands Group for 220 million dollars. It has 1,700 own stores and more than 1,400 concessions spread across 13 countries. It invoices 34% of its business in the American market.

bestseller

2.851 million. The Danish group, like some of its rivals, also took advantage of the covid-19 to continue optimizing its structure, improving delivery times to multi-brand stores and customers; and even to expand its offer, with the announcement of the launch of a Jack & Jones. Founded in 1975, it has 2,600 stores in 38 countries, and distributes the Jack&Jones, JJXX, Vero Moda, Only or JDY brands.

C&A

3,236 million. The group based in Belgium and Germany owned by the Brenninkmeijer family has lightened its structure in the last year with the sale of its business in Mexico and China, which is added to the divestments in the Brazilian market in 2019. Its latest data on Billing, in 2019, was 6,700 million, with a global network of almost half a thousand stores.

The group completes the generational change initiated by the textile families

The Galician textile industry is Inditex and much more. There is a powerful sector, made up of 300 small and medium-sized companies, the majority of which are family-owned, which has been able to maintain itself, but now it needs to guarantee its future, and it has begun to do so by paving the way for generational replacement, in a process that began a few years ago. years that now culminate in the bosom of the Ortega family, with the arrival of Marta Ortega to the presidency of Inditex.

The children of the first batch of Galicia Fashion have studied Economics, Business or Business Management and Administration, they have master's degrees abroad, they think and speak in several languages, and many of them are digital natives hungry to eat the appetizing online market that chokes their parents.

Adolfo Domínguez, Alba Conde, Florentino, Selmark, Nanos, Foque or the ill-fated Pili Carrera are some of the examples of the generational transition process already accomplished, although under the formula of coexistence of parents and children within a scheme family business.

In this process, the leadership role that women are assuming stands out, with Marta Ortega presiding over the Galician textile giant as a culmination of the efforts assumed by Adriana Domínguez at the head of Adolfo Domínguez, Cristina Mariño in the case of Roberto Verino or the sisters Uxía and María Domínguez leading Bimba and Lola.

In 2017, after several months without a chief executive, Adolfo Domínguez's board of directors trusted the designer's eldest daughter, Adriana Domínguez, to lead the new stage of the company and redirect the course. In 2018, Domínguez was appointed CEO and continued with the reorganization of the company.

The Galician firm Roberto Verino, one of the most representative of the brilliant eighties, ends 2021 completing a reorganization that began in 2019 with the creation of a division divided into two: Dora Casal, executive director, and Cristina Mariño, daughter of the founder and brand director. After this process, Roberto Verino is directed by the Mariño-Casal tandem, who share the executive functions: while the first is in charge of the brand, the second leads the areas of international, digital, human resources, logistics, e-commerce and marketing.

For every 40 euros produced in Galicia, one depends on Inditex

G. Lemos

The replacement at the top of Inditex, with the scheduled ascent of Marta Ortega to the presidency on April 1 and the appointment, already effective, of Óscar García Maceiras as the new CEO, is a transcendental movement not only for the future of the company, but also for the Spanish economy as a whole, due to the weight of the textile giant in terms of GDP, employment, tax contribution and foreign trade.

A contribution that the multinational itself calculated, seven years ago now, through a study commissioned to the consulting firm PwC, which estimated that textiles then represented 0.5% of the Spanish gross domestic product (GDP), with a contribution of 4,359 million annually to the national wealth. In the case of Galicia, the headquarters effect raised the weight in the economy to 2.4%, with an activity equivalent to 1,245 million a year. In other words, Inditex moves (directly, indirectly and induced) one of every forty euros produced in Galicia.

WhatsappMailFacebookTwitterComment ·

© Copyright LA VOZ DE GALICIA S.A.Polígono de Sabón, Arteixo, A CORUÑA (SPAIN) Registered in the Mercantile Registry of A Coruña in Volume 2438 of the Archive, General Section, on pages 91 and following, page C-2141. CIF: A-15000649.

Legal warningPrivacy policyCookies policyGeneral conditions